11 Habits That Keep You Poor (And How to Break Free From Debt)

Have you ever felt like you’re stuck in a financial rut? Like no matter how hard you try, your savings never grow, and debt feels like an insurmountable mountain? You’re not alone. Breaking free from financial struggles often requires looking inward, identifying the habits holding you back, and making intentional changes.

Let’s explore 11 common habits that can keep you poor and learn actionable ways to replace them with empowering strategies that lead to financial freedom.

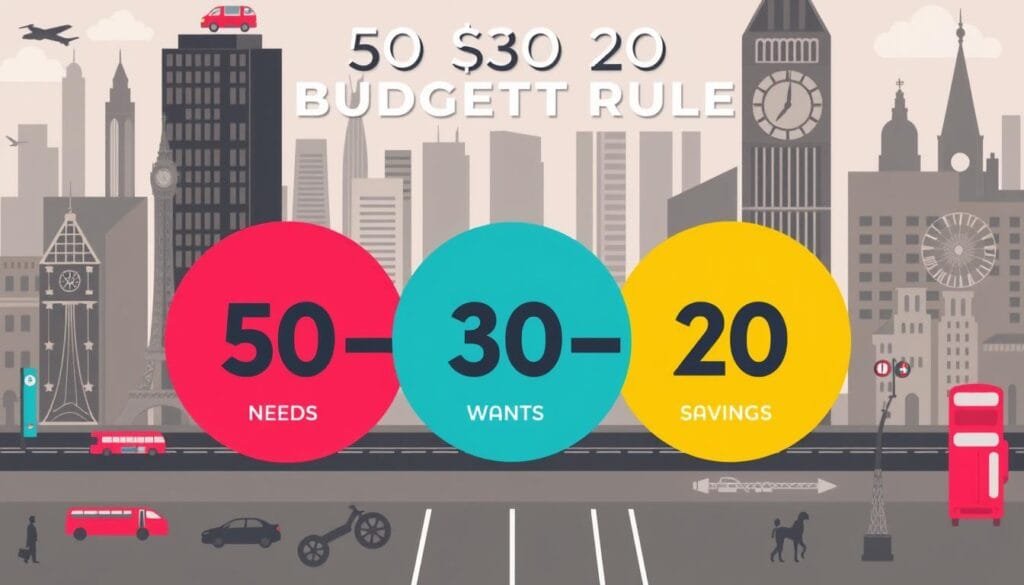

1. Living Beyond Your Means

The Habit:

Do you feel pressured to keep up with friends or social media influencers, even if it means spending more than you earn? Constantly using credit cards or loans to maintain a lifestyle beyond your income can trap you in a cycle of debt.

Why It Happens:

Society glorifies material success. From the latest iPhone to luxury vacations, the pressure to “appear wealthy” often overshadows financial reality.

How to Break Free:

- Create a realistic budget that prioritises your needs over your wants.

- Embrace the mantra, “Live like no one else now so you can live like no one else later.”

- Tools like YNAB or Money Dashboard can help you track spending.

2. Impulse Buying

The Habit:

Impulse purchases feel beneficial in the moment but often lead to the buyer’s remorse. Those £20 here and £30 there add up faster than you realise, leaving little room for savings.

Why It Happens:

Retailers exploit emotions through sales, scarcity tactics, and convenience. A “limited-time offer” can cloud judgement.

How to Break Free:

- Implement a 24-hour rule: Before buying anything non-essential, wait a day.

- Use wishlists instead of immediate purchases, allowing you time to evaluate if the item is truly necessary.

Quick Tip: Apps like Clearpay and Klarna make impulse buying too easy. Avoid them if possible.

3. Not Having an Emergency Fund

The Habit:

Life throws curveballs—unexpected car repairs, medical bills, or job losses. Without a safety net, you’re forced to rely on credit, plunging deeper into debt.

Why It Happens:

Many people prioritise immediate expenses over building a financial cushion, thinking, “I’ll start saving when I have extra money.”

How to Break Free:

- Start small: Save £10-20 a week into a dedicated emergency savings account.

- Automate your savings so it happens without you thinking about it.

Inspiration: Imagine the peace of mind knowing you can handle emergencies without panic or borrowing.

4. Carrying Credit Card Balances

The Habit:

Paying only the minimum on your credit card keeps you trapped in a cycle of interest payments. A £1,000 balance can take years to pay off with interest.

Why It Happens:

Many people underestimate how much interest adds up, or they rely on credit as an extension of their income.

How to Break Free:

- Focus on the snowball method: Pay off the smallest debts first for quick wins.

- Alternatively, try the avalanche method: Pay off high-interest debts first to save money.

- Tools like MoneyHelper’s Debt Calculator can help.

5. Ignoring Financial Planning

The Habit:

Without clear goals, it’s easy to drift through life financially unprepared, spending instead of saving and living pay check to pay check.

Why It Happens:

Many fear planning because it feels overwhelming or restrictive.

How to Break Free:

- Write down 3 financial goals (e.g., save £5,000, buy a house, retire at 60).

- Break these goals into actionable steps with deadlines.

- Consider working with a financial advisor or using apps like Plum for automated planning.

6. Not Tracking Expenses

The Habit:

Not knowing where your money goes leaves you vulnerable to overspending and debt. Have you ever checked your bank account and wondered, “Where did it all go?”

Why It Happens:

Many avoid tracking expenses because it feels tedious or because they’re afraid to confront their habits.

How to Break Free:

- Track every penny for one month. Apps like Emma or Monzo can categorise spending automatically.

- Use this data to create a realistic budget that reflects your priorities.

Emotional Benefit: You’ll feel empowered when you see exactly where your money is going and take control.

7. Paying Only the Minimum on Debts

The Habit:

Minimum payments keep debt collectors away, but do little to reduce what you owe. Over time, interest can double or triple the original amount borrowed.

Why It Happens:

Tight budgets and the psychological relief of meeting the “minimum requirement” can create complacency.

How to Break Free:

- Allocate extra income (bonuses, tax refunds, side hustle earnings) directly to debt.

- Consider consolidating high-interest debts into a lower-rate loan.

8. Neglecting to Save for Retirement

The Habit:

It’s tempting to think, “I’ll save later when I earn more.” Unfortunately, delaying retirement savings means missing out on the power of compound interest.

Why It Happens:

Many prioritise immediate expenses over long-term goals.

How to Break Free:

- Start small: Contribute 5-10% of your income to a workplace pension or a private retirement fund.

- If your employer offers a contribution match, take full advantage.

9. Succumbing to Lifestyle Inflation

The Habit:

As income rises, so do expenses. Upgrading your car, buyingpricier clothes, and dining out more often can cancel out raises or bonuses.

Why It Happens:

Psychologically, people feel they “deserve” more after working hard.

How to Break Free:

- When you receive a raise, direct 50% of it to savings or investments.

- Focus on delayed gratification: Enjoy a modest lifestyle now to build wealth for the future.

10. Not Seeking Financial Advice

The Habit:

Many people struggle alone, making uninformed financial decisions that cost them money.

Why It Happens:

Fear of judgement or the belief that financial advice is only for the wealthy can hold people back.

How to Break Free:

- Seek help from free services like Citizens Advice or StepChange.

- Consider consulting a financial advisor for personalised guidance.

11. Procrastinating on Financial Decisions

The Habit:

Putting off key financial tasks, like starting an emergency fund or creating a budget, only delays progress and increases stress.

Why It Happens:

It’s common to feel overwhelmed or think you’ll have more time “later.”

How to Break Free:

- Start small: Commit to tackling one financial task today, like setting up a savings account or listing your debts.

- Use the 5-Minute Rule: Spend just five minutes starting the task to build momentum.

Breaking Free from Debt Starts with You

Breaking old financial habits isn’t easy, but it’s worth it. Every small change you make is a step toward freedom, security, and the life you truly want.

Take Action Today:

- Create your first budget using tools like MoneyHelper.

- Start building your emergency fund with our money-saving challenge guide.

- Explore how cashback apps can help you save more here.

Remember: Financial freedom isn’t about how much you earn—it’s about how much you keep and how you use it. Start your journey today.